This guest post contributed by Matt Cumello, Vice President of Marketing for MRI-Simmons.

Unless you’ve been living under a rock for the past few years, you are undoubtedly aware of the long planned “death of the cookie”. Now delayed until the “second half of 2024”, Google will be doing away with third-party cookies in its Chrome browser. As a result, companies will lose the ability to track consumers across websites, and marketers will lose the ability to leverage those cookies for campaigns, insights, or measurement. In parallel, new privacy-forward technologies like Apple’s ATT framework now require companies to acquire explicit permission from consumers before any data can be collected.

These developments, along with evolving legislative issues, have led marketers to seek new data sources that can fill the void left by the deprecation of third-party cookies. That’s no simple task as any such solution must protect consumer privacy while allowing for more personalized ad experiences and accurate campaign measurement. And as the industry eyes a future of multi-currency measurement, the demand for transparency, and need for high-quality representative datasets is growing stronger each day. So where can marketers turn?

First- and Zero-Party Data to the Rescue? Not entirely.

Marketers are immersed in first-party data – whether that be CRM data, sales numbers, or digital KPIs. However, with the impending death of the cookie, some have suggested that marketers must rely on this first-party and/or zero-party data to fill that void. While both of those data sources will certainly play a role in a brand’s future marketing efforts, the challenge will always be scale, and representation! First- and zero-party data can provide some detail about your customers (demographics, location, etc), but that data almost always needs to be enhanced or enriched to provide full value.

Consider also that many customers will decline a brand’s attempt to collect their data, so those brands will not have a fully representative view of their own customer. Moreover, relying on a single data-source like data from a CRM system will provide no insight into the competition’s consumer. This is where first- and zero-party data will fall short.

Bottom line – if big data is not representative of everything a brand seeks to understand and it is not validated, it can lead to bad conclusions and wasted investments. To get a full picture of a target consumer, marketers should look to other datasets to help enhance their first-party data.

Enter Data Enrichment

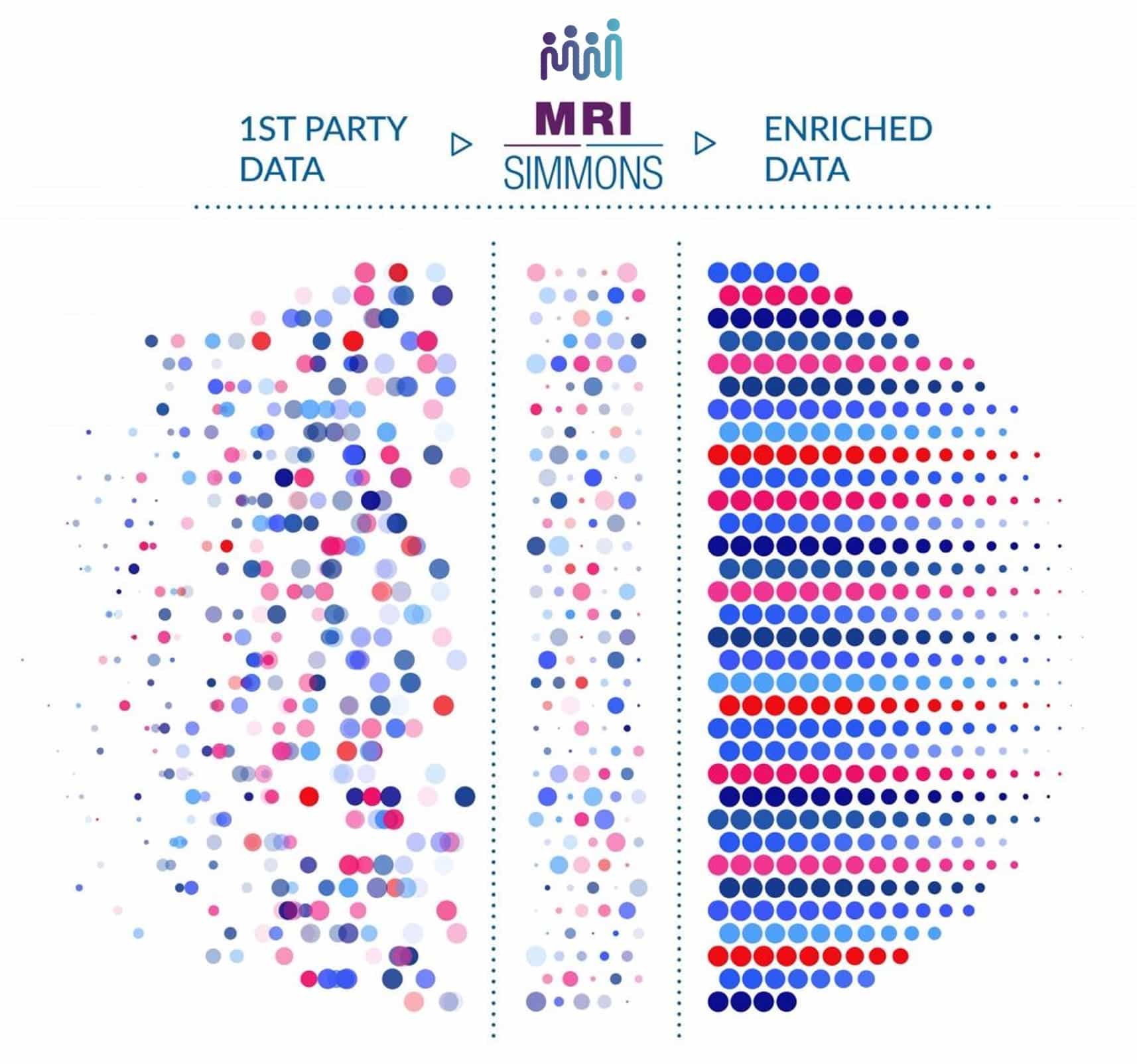

Data enrichment is a process where first-party data sources (like CRM or sales data) are combined with other datasets. One can clearly see how this practice will grow in importance as the market continues to evolve in the way it thinks about data-driven decision making.

The benefits are many. With data enrichment, marketers can:

- Enhance first-party data to create comprehensive customer profiles that include psychographics, online and offline behavior, attitudes, and more.

- Supplement first-party data to better understand competitors and other variables outside your category that affect your business.

- Uncover what you don’t know about your customers and prospects (how they spend leisure time, what their values are, what they do offline, etc).

- Improve consumer targeting for customer acquisition or promotions.

- Extend the utility of their database to identify market, and partnership opportunities.

Bridging the gap with consented, representative datasets

Even with the established and growing value of data enrichment, it’s important to note that all datasets are NOT created equal. When it comes to consumer research, varying methodologies can yield wildly different results and levels of accuracy. A lack of understanding on the basic credentials of a dataset can lead to unnecessary risk, poor marketing results, and a waste of money.

In a previous blog post, my colleague Josh Pisano outlined 5 key questions that marketers must ask before taking insights to action. Those questions included:

- How representative is the data?

- How is the data collected?

- How consistent is the data?

- Can results be trended and/or benchmarked?

- Is there good data hygiene?

At the end of the day, the reliability of a data provider ultimately comes down to the quality of the source. There aren’t a ton of data sources available that check all of the boxes above. And that is due primarily to the high cost associated with fielding consumer surveys that yield a nationally-representative and accurate view of the American consumer.

This is where companies like AnalyticsIQ and MRI-Simmons come in. MRI-Simmons produces one of the few nationally representative, privacy-forward datasets that can be used to validate, connect, and enrich first-, second-, and third-party data. The MRI-Simmons USA Study helps marketers understand consumers across tens of thousands of data points — including what they think and value — that can be combined, customized, and integrated to identify, activate, and capture additional opportunity for a business. Perhaps more importantly, MRI-Simmons USA is audited annually by a third-party, making it one of the most trusted datasets for data enrichment and cross-screen activation.

When you combine a high-quality, representative and trusted data source like MRI-Simmons with an innovative data science and predictive analytics solution provider like AnalyticsIQ, you have a solution that can tell you what you don’t know about an existing customer and is highly actionable.

A Case Study in Data Enrichment: Profiling Vevo Viewers within a Walled Garden

Vevo is the world’s leading music video network. With more than 800,000 videos, Vevo controls the largest network of music channels on YouTube, as well as streaming apps and linear-programmed channels across 35 CTV platforms. While Vevo is able to obtain some basic information like number of views and demographics for viewers of their content, they desired a deeper understanding of their viewer’s behaviors and opinions. In addition, Vevo wanted to provide advertisers with consumer profile reports, by channel, showing who they are reaching. These profile reports would be used to demonstrate why advertising on Vevo channels within FAST (Free Ad-supported Streaming TV) was a value add for brands.

In August of 2021, Vevo partnered with MRI-Simmons to profile their video viewers on their FAST channels. After evaluating multiple identity providers to match Vevo’s viewership data, MRI-Simmons found that AnalyticsIQ’s identity spine yielded the strongest match to the MRI-Simmons USA Study, the leading study of American consumers. By matching the IP addresses of Vevo’s content viewers on TV apps to its respondents, MRI-Simmons was able to develop rich demographic, psychographic, and behavioral profiles. MRI-Simmons also identified key advertising categories across specific Vevo channels and Smart TV platforms.

The project is just one example of the many ways that media or marketers can enrich an existing data set to drive additional value. To learn how you too can leverage data sources like MRI-Simmons and AnalyticsIQ to enrich first-, second- or third-party datasets, contact info.ms@mrisimmons.com or sales@analyticsiq.com today.

About the author

Matt Cumello is Vice President of Marketing for MRI-Simmons, responsible for marketing strategy and execution. Matt has over 20 years of B2B marketing experience, having worked with both start-ups and established companies in market research and technology.