The latest research conducted by the Department of Cognitive Sciences takes a closer look at the impact inflation has on consumer behavior.

Inflation and Price Hikes Impact Consumers

Economists project high inflation will continue. Some predict months, while others say it will be years before we return to the ~2% annual increase we had become accustomed to. But all economists agree that high inflation is absolutely impacting consumer spending behavior and choices.

In late 2022, the Cognitive Sciences Department at AnalyticsIQ conducted a survey focused on the impact and effects of inflation in the United States. In our research, we take a look at how that is impacting consumers and how businesses can adapt to ease the burden on consumers financially.

DOWNLOAD THE INFLATION IMPACT RESEARCH REPORT NOW

Not all consumer segments will feel the same impact

It may feel obvious that families with children think about tightening their belts differently than a young bachelor. A consumer’s unique attributes drive the majority of decisions we make every day, so it’s important to have a robust dataset to analyze problems like this. Our research looks at a wide variety of demographic variables to compare how they are impacted by inflation.

A few examples included in our research include:

- Generational impact (Gen Z, Millennials, Gen X, and Boomers)

- Race

- Gender

- Highest level of education completed

Making changes to your personal spending and investing can mean many things

Some consumers change their behaviors by canceling some expenditures altogether (EX: travel) or reducing the volume at which they would spend (EX: dining out less). Others make substitutions to bring costs down. An example of this would be selecting a cheaper store brand of shampoo rather than the salon brand a consumer was previously purchasing.

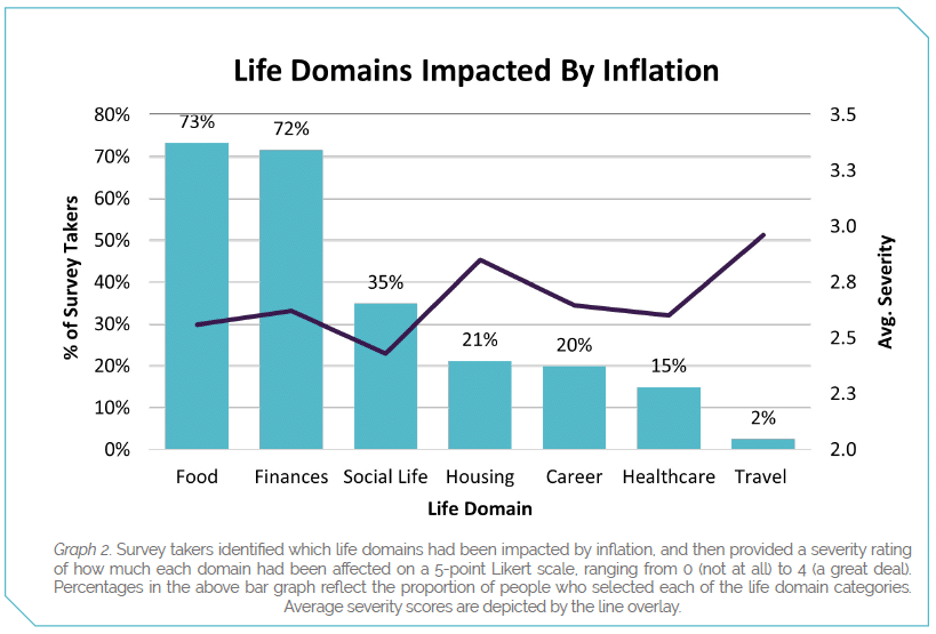

Our research on the impact and effects of inflation explored the categories each of these groups were likely to select for more or less financial restriction.

- Food

- Finances

- Social Life

- Housing

- Career

- Healthcare

- Travel

We also looked at which categories experienced the greatest level of impact due to inflation. We ranked the severity of the impact on a scale from 0 (not at all) to 4 (a great deal), to help us uncover which expenses saw extreme or minimal changes to better manage the rising costs of regular ones.

The emotional impact of inflation and its rising costs

Making cuts across categories can become an emotional task. Especially for expenditures that may provide convenience or feel necessary. In combination with the saving methods, we also asked respondents about how inflation was affecting them emotionally. The specific aspects evaluated include:

- Stress

- Anxiety

- Sadness

- Happiness

- Contentment

- Life Satisfaction

- Financial Stability

Inflation is the most common stressor in the United States. 87% of respondents indicated that the rise in prices of everyday items due to inflation was a source of significant stress. –Stress in America

American Psychological Association

The impact of stress is one we all feel daily, but can lead to longer-term outcomes like divorce and declined physical health.

How does inflation affect businesses?

Companies across all industries are impacted.

No category is safe from the effects of inflation. From healthcare to travel and entertainment, marketers need to consider how to adjust their message for consumers that may be “feeling the pinch” or risk coming off tone deaf. This is especially true for brands that have women as a key demographic as the impact of inflation was shown to impact women in a much greater way.

DOWNLOAD THE INFLATION IMPACT RESEARCH REPORT NOW

Curious how your specific audiences respond to economic changes? Reach out to discuss how our consumer database PeopleCore, with EconomyIQ data, can help predict future changes in behavior.

About the Department of Cognitive Sciences at AnalyticsIQ

AnalyticsIQ is the first data company with a focus on cognitive psychological research and its power to create unique and predictive data. Unlike a typical “survey”, all our questions are designed by Cognitive Psychologists to get behind the WHY leading consumers to make decisions. This unique type of data is helpful in times when consumer behavior is volatile — and previous behaviors alone are not enough to predict future behaviors.

This is also important for brands releasing brand new product types that may require custom research to craft an ideal audience. For example, in 2008, before Uber was widely available, how would a rideshare app marketer know which audiences to target? Without predictive data, they were likely guessing based on loosely related segments like taxi users or business travelers.

Looking for a specific data variable that seemingly doesn’t exist yet? No problem. Our Cognitive Sciences team focuses on solving for market changes and understanding consumer behaviors every day. We speak geek, so reach out to our team by clicking here and we’ll be in touch!