As the NHL and NBA playoffs light up screens across the country, marketers and advertisers have a rare moment to seize the passion of two highly engaged, yet distinctly different fanbases by understand fan personas. But to make the most of this opportunity, it’s not enough to simply know who these fans are—you need to understand what drives them, how they live, what they buy, and why they make the choices they do.

At AnalyticsIQ, our PeopleCore data offers more than just surface-level demographics. We blend cognitive psychology with data science to help brands understand who people are, what they do, and why they do it. And when you look at hockey and basketball fans through that lens, their differences create a compelling story—and even more compelling marketing strategies.

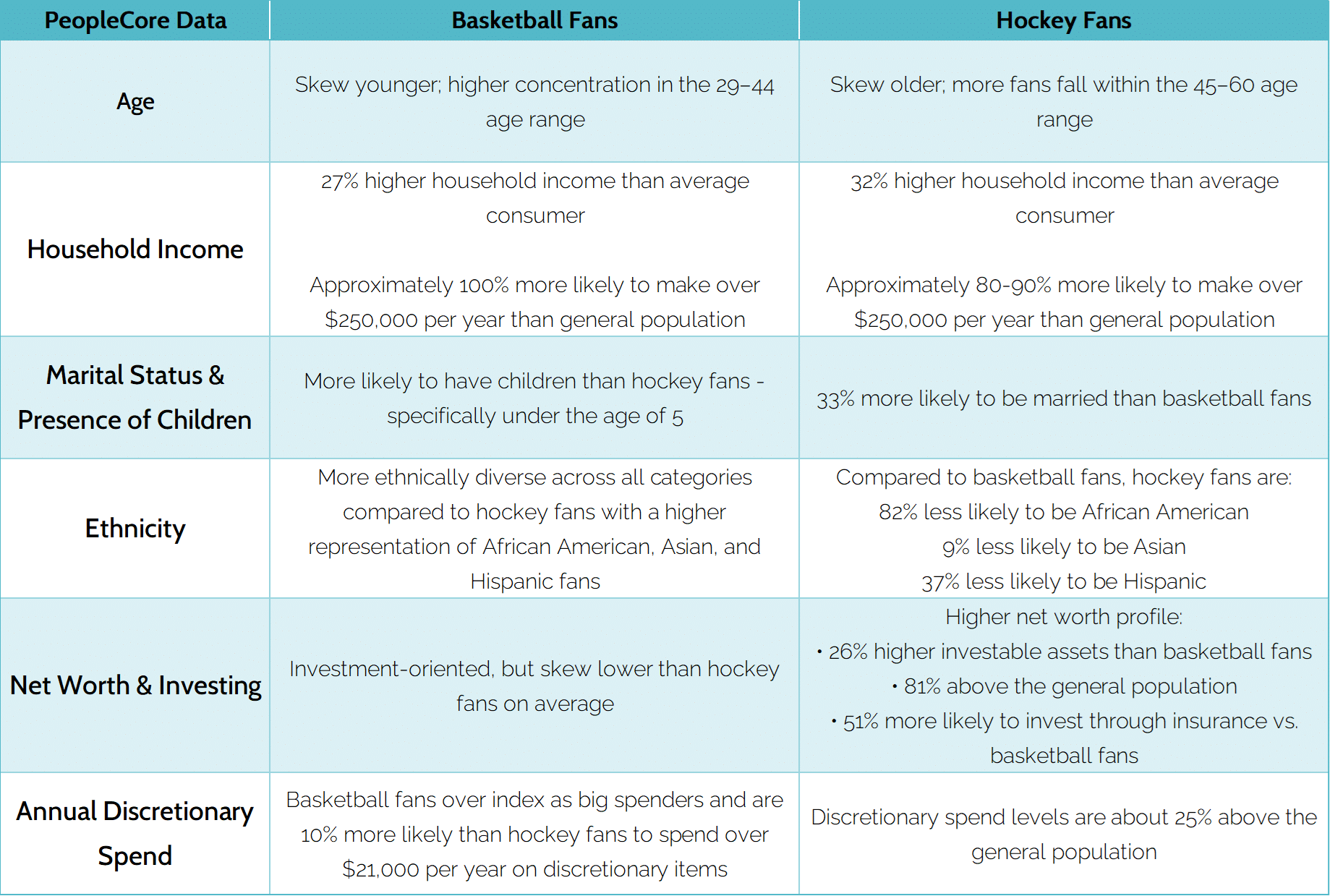

Demographics & Financial Profiles: A Tale of Two Wallets

While both fan personas span a range of ages, hockey fans tend to skew slightly older, often rooted in regions with long-standing NHL legacies. Basketball fans, meanwhile, skew a little younger and have a different viewer profile and audience in general.

- Age distribution – Basketball fans skew more towards the younger side with more basketball fans falling between the 29-44 age range and hockey fans more towards the 45-60 age range.

- Household income brackets – Both fan bases have an above average income vs the general population, around 30% higher, with much higher representation in the $250,000-$999,000 range than the general population.

- Marital status and presence of children – Hockey fans are more likely to be married than basketball fans, about 33% more, while basketball fans are slightly more likely to have children.

- Ethnicity and multicultural identifiers – Compared to basketball fans, hockey fans are 82% less likely to be African American, 9% less likely to be Asian, and 37% less likely to be Hispanic.

- Net worth and investable assets – Both fan bases have income investment strategies with hockey fans skewing higher than basketball fans by about 26% and 81% above the general population. Hockey fans are also much more likely to have an insurance investment strategy than both basketball fans and the general public, at over 51% and 61% more respectively.

- Discretionary spend index – Both fan personas spend around the same, which is around 25% more than the general population with basketball fans more likely to spend big over the next 12-months.

Lifestyle Interests: One Stadium, Two Worlds

Basketball fans are culturally driven, with a strong affinity for music, streetwear fashion, sneakers, and celebrity culture. Many are trend-forward and connected to emerging tech platforms. Hockey fans, on the other hand, tend to value tradition, loyalty, and travel.

- Hobbies and lifestyle interests – Basketball fans are much more likely to purchase music online compared to the general population, around 143% more. Both basketball and hockey fans enjoy the outdoors, in fact both fan bases enjoy the outdoors roughly 115% more than the general public. Basketball fans shop for clothes online 30% more than, in store 25% more than, and thrift 34% more than hockey fans.

- In-market intent for key consumer categories – Both fan bases are much more likely to buy electronics than the general population, with hockey fans 200% more likely in fact! Basketball fans are much more likely to purchase clothing and fashion related items from ads compared to hockey fans and are more likely to make these purchases on Amazon.

- TV and media content affinity – Basketball fans are much more likely to watch the family shows compared to hockey fans, at about 137% more. Basketball fans are also much more likely to binge TV than hockey fans – 88% more likely than the general public! Both fan bases are also big fans of Sci-Fi with both being over 100% more likely to watch the genre compared to the general population!

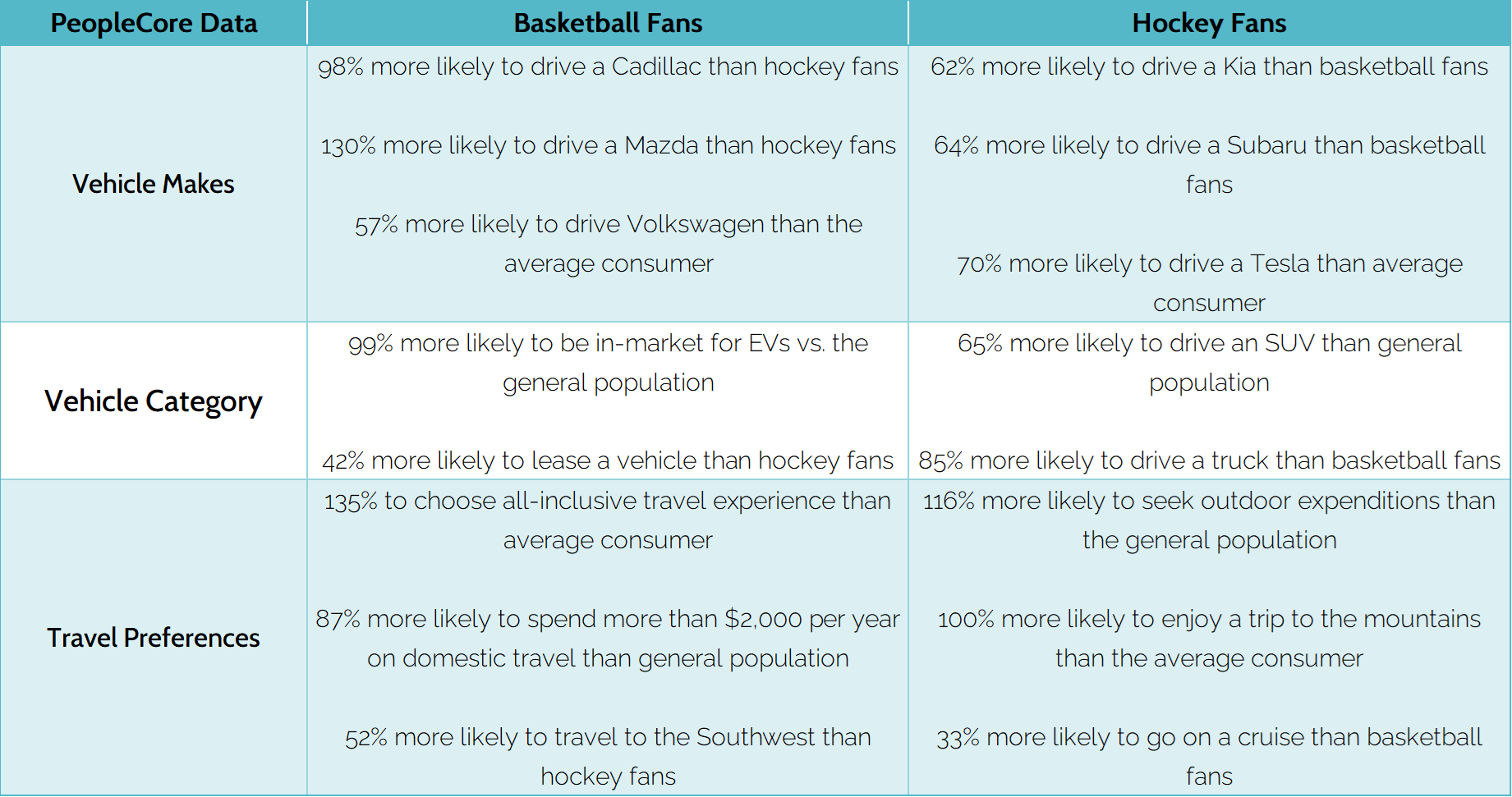

Auto & Travel Preferences: The Road Warriors

When it comes to wheels, hockey fans show stronger affinity for trucks, SUVs, and premium German brands — vehicles that fit the snowbelt lifestyle and communicate quiet wealth. Basketball fans trend toward sporty sedans, EVs, and urban-friendly rides. While both fan bases show significant interest in travelling internationally and domestically, it’s where they travel to that differs.

- Vehicle make – Both fan personas have their distinct auto brand preferences – and they couldn’t be more different! From innovative Teslas to classic Cadillacs, hockey and basketball fans represent strong opportunities for the makes they prefer.

- Vehicle Category – Basketball fans are nearly 100% more likely to be in the market for an electric vehicle than the average consumer and are more likely to lease a vehicle than their hockey fan persona counterparts. Hockey fans may have more traditional preferences such as SUVs and trucks.

- Domestic or international travel – Both fan bases enjoy travelling, with basketball fans 87% more likely to spend big domestically and 55% more likely to travel internationally than the general public, fairly similar to hockey fans. Hockey fans are 100% more likely to travel to the mountains whereas basketball fans travel to the Southwest. And when the ice thaws, hockey fans are probably heading on a cruise!

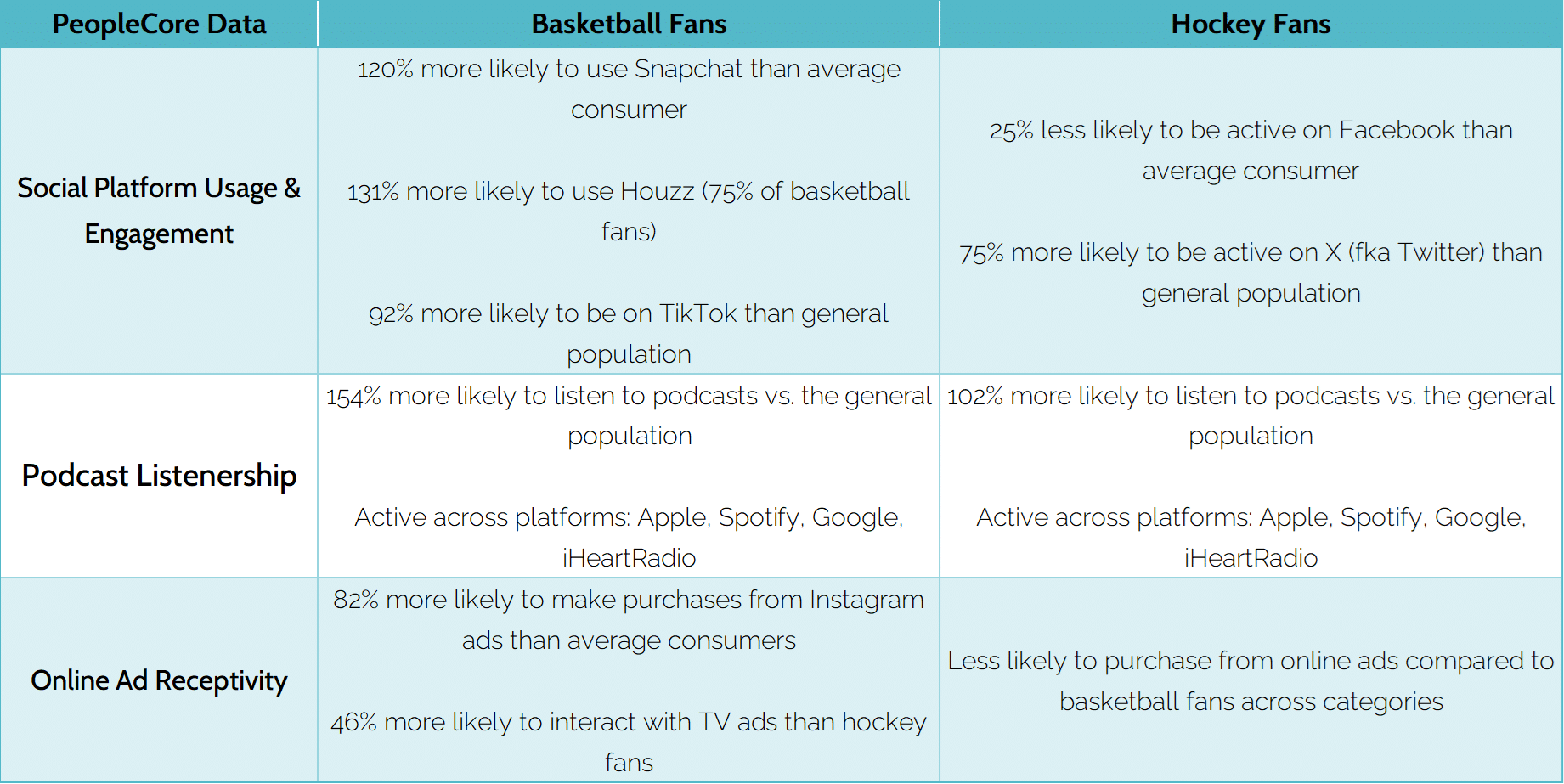

Channel & Social Media Engagement: Eyes on the Screen

Basketball fans are digital natives. Their presence on platforms like TikTok, Instagram, and podcast listening apps makes influencer partnerships a natural fit. Hockey fans? They’re more likely to engage on legacy platforms with long-form content.

- Social platform usage and engagement – You’ll most likely find both basketball and hockey fans on Snapchat, with basketball fans being 120% more likely than the general population to be on the platform and hockey fans being roughly 80% more likely. Another strong platform to reach basketball fans on is TikTok, where the fanbase is 92% more likely to be on the app compared to the general population. If you’re looking for another platform to reach hockey fan personas, head on over to X (fka Twitter).

- Podcast listenership – Both fan bases are big podcast fans. Basketball fans are 154% more likely and hockey fans are 102% more likely to also be a fan of podcasts than the general public. That’s across several offerings including Apple, Spotify, Google, and IHeartRadio.

- Online ad receptivity – Basketball fans are more likely to purchase items after seeing an ad on Instagram whereas hockey fans are less likely to make purchases online across the board.

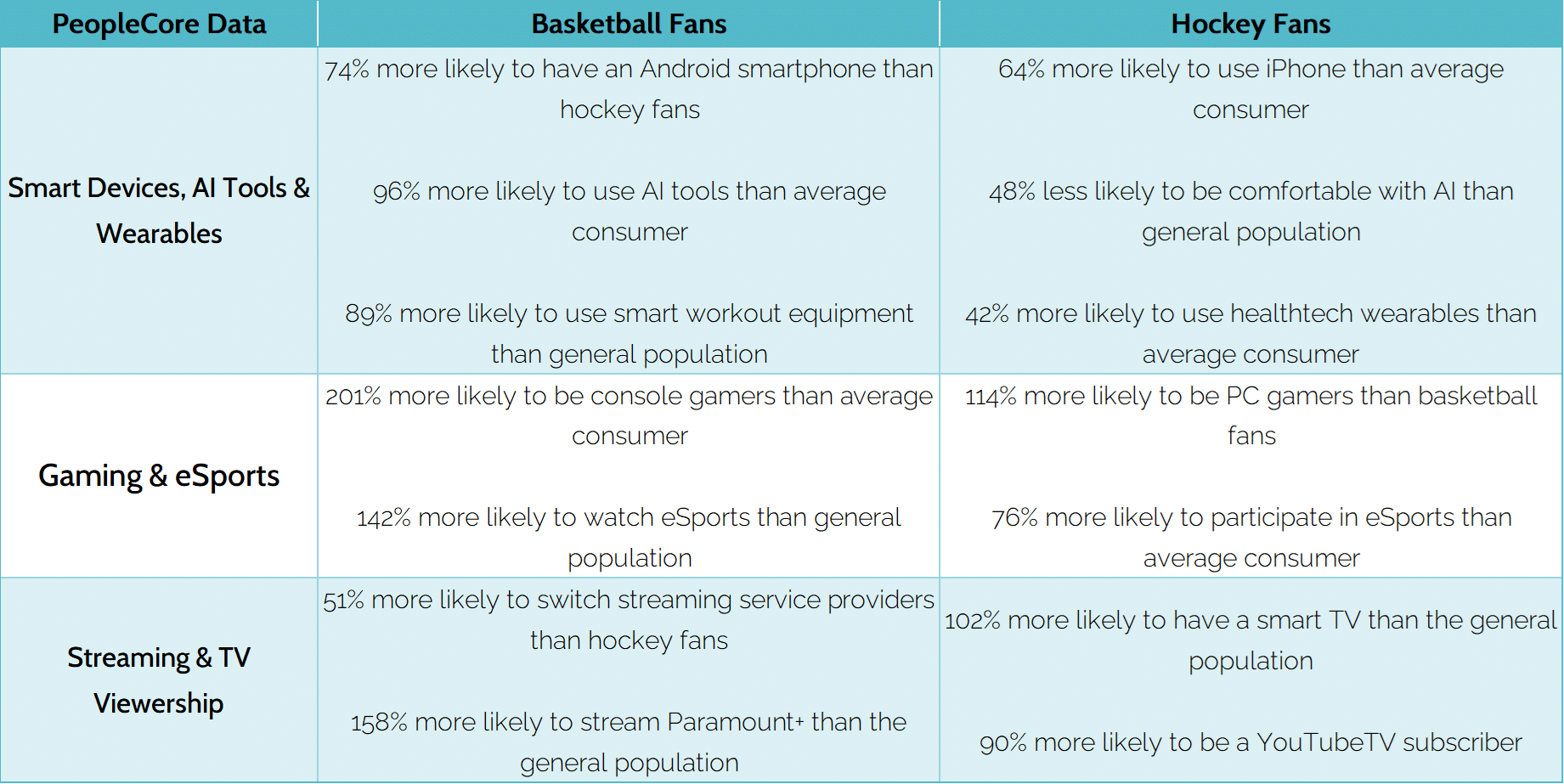

Technology & Gaming: Court Kings vs. Ice Titans

Basketball fans index higher for console gaming, streaming esports, and playing mobile games. Esports is a growing area of engagement among this group. Hockey fans, while not disengaged, lean toward strategy and sports simulation genres. They’re less likely to experiment with bleeding-edge tech, but they value reliability and security.

- Ownership or interest in smart devices, AI tools, or wearables – Basketball fans are much more likely to be Android smart phone users than the average consumer, roughly 74% more. Basketball fans use AI on a daily basis much more than the general population at 96% more, and roughly 32% more than hockey fans. Both fan bases also wear health smart devices more than the general public, with basketball fan personas opting for smart workout equipment 89% more often than the population while hockey fans are 42% more likely use healthtech wearables.

- Gaming platform engagement (console vs. PC vs. mobile) – Both fan bases are involved in gaming, with basketball fans over 200% more likely to be console gamers while hockey fans prefer PC gaming. Basketball fans like to watch eSports, but you can catch hockey fans playing!

- Streaming viewership behavior – Both fan personas enjoy streaming content, but platform preferences differ with basketball fans much more likely to watch Paramount+ and hockey fans more likely to watch YouTubeTV.

Purchasing Behaviors & Motivations: Conversion Ready

Finally, how these two fan personas respond to advertising and who they are as people offers a compelling window into campaign planning. Basketball fans are more spontaneous and influenced by peer reviews, social proof, and influencer content. Hockey fans, by contrast, take longer to influence and respond better to expertise-driven messaging.

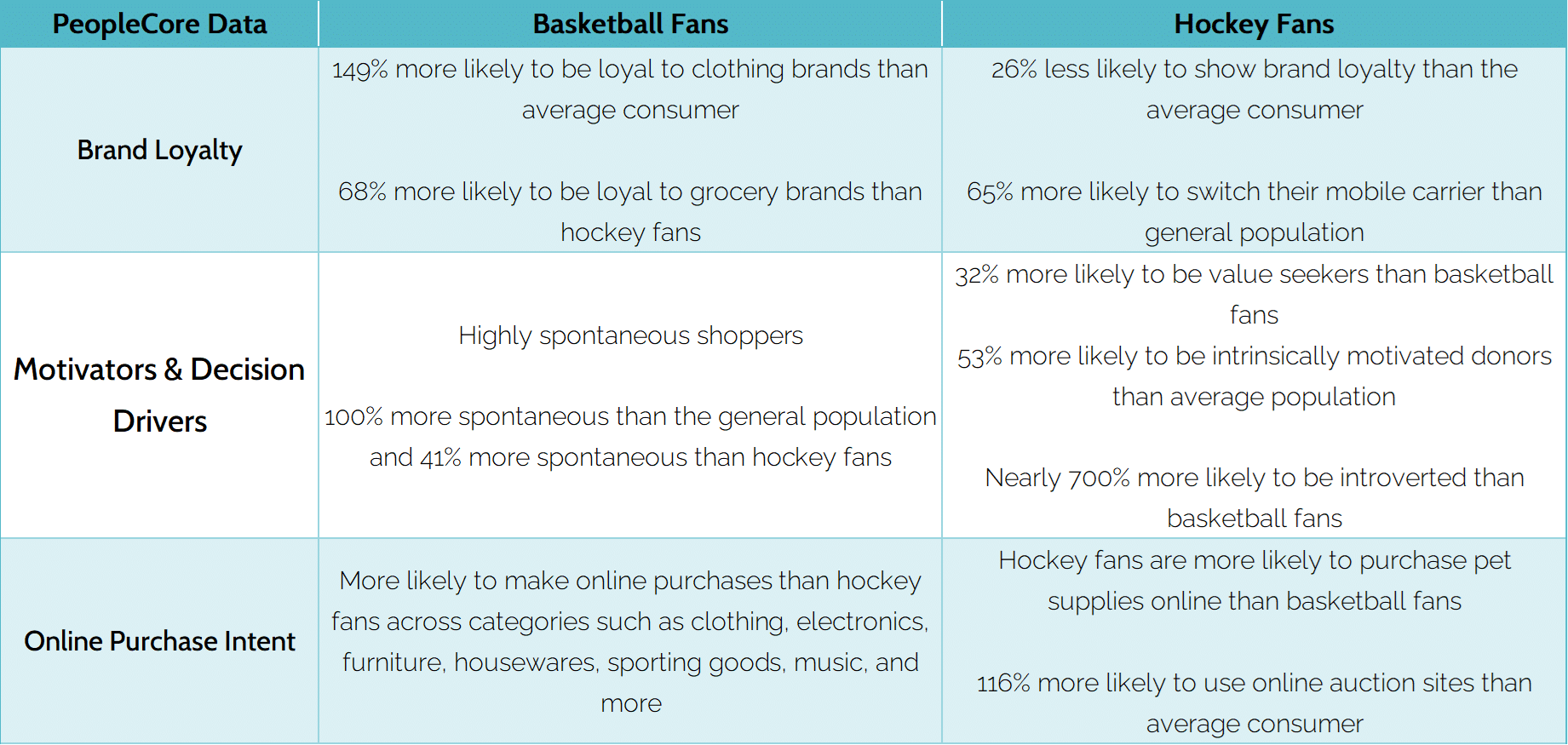

- Brand switching likelihood vs. loyalty – When it comes to mobile service providers, clothes, groceries, or even just general loyalty to a retail brand, basketball fans tend to be more loyal than hockey fans. Basketball fans are roughly 150% more loyal to clothing brands than average and 68% more loyal to grocery brand than hocky fans. Hockey fans are generally less loyal, particularly when it comes to their mobile carrier.

- Primary motivators and personalities – Basketball fans spontaneous shoppers and likely to respond to time sensitive offers. Hockey fans are more likely to be value seekers and make careful internal considerations before making purchases.

- Online purchase behaviors – Basketball fans are more likely to make online purchases across a variety of categories compared to hockey fans. However, you can catch hockey fans bidding on their favorite items on auction sites.

Final Whistle: A Win for Smart Advertisers

Marketers who lean into data-driven storytelling during the playoffs have a powerful chance to reach emotionally engaged fans—on their terms, in their channels, and with the messages that matter.

Whether you’re selling sneakers or SUVs, trips to Tahoe or crypto apps, knowing who your audience is and why they buy is everything. And with AnalyticsIQ’s PeopleCore data, you don’t just see the fan—you see the person behind the jersey.

👉 Ready to craft fan-first campaigns that convert? Let’s build the audience that will win your next campaign. Reach out to our team by clicking here and we’ll be in touch! Or explore the power of PeopleCore today.