Know Your Customer. Not Just an Account Number.

As finance has gone mobile, the competition for member loyalty has grown. Now, banks, credit unions, fintech companies, and even consumer brands have their own accounts, credit cards and loyalty programs. This puts a lot of pressure on financial services marketers who are tasked with reaching their audience via digital channels, all while navigating complex regulations.

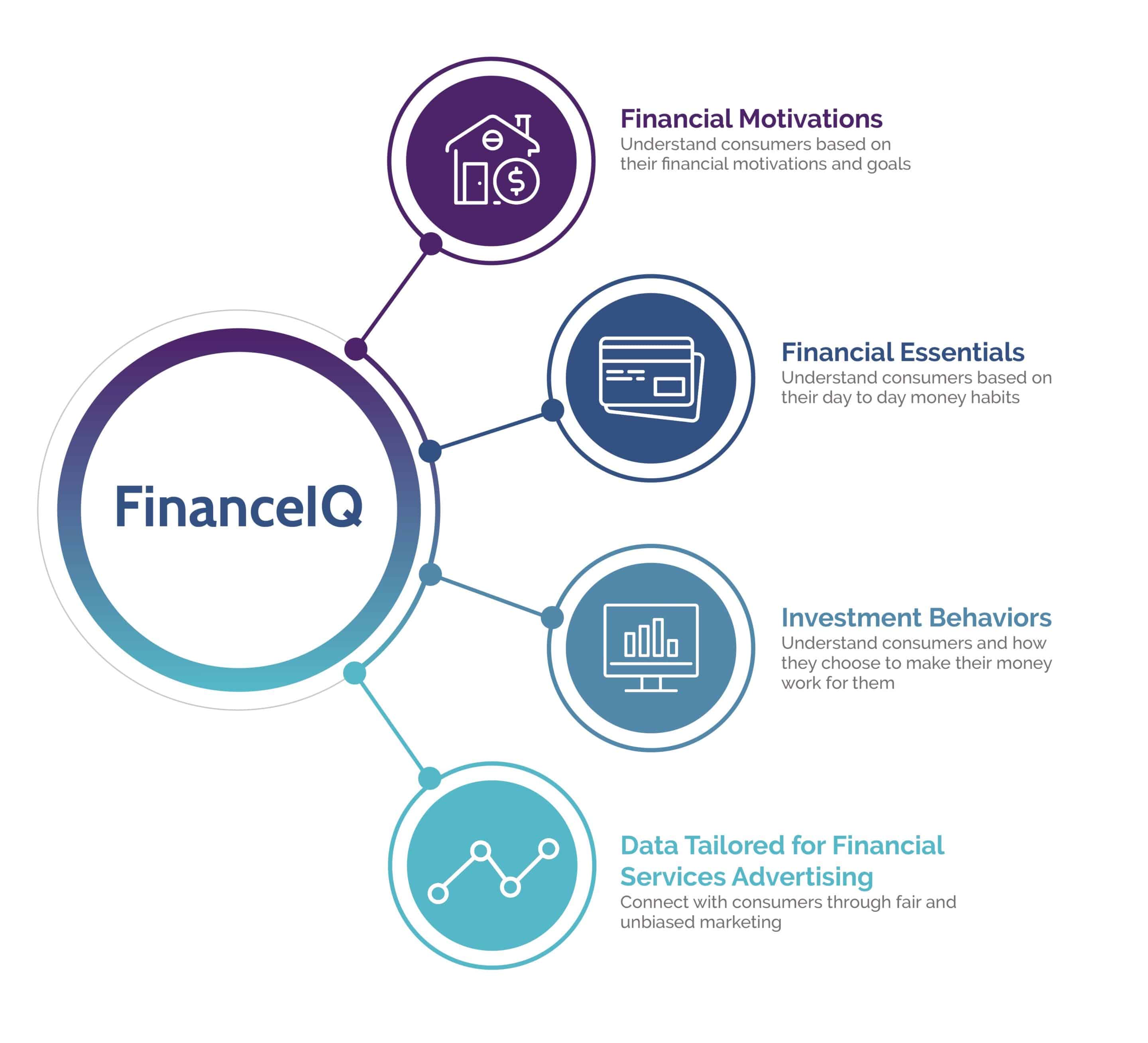

To capture and keep the attention of savers, spenders and investors, marketing campaigns must reflect consumers’ lifestyle, life stage, behaviors and motivations. AnalyticsIQ’s data gives powerful individual and household insights that power modeling and analytics and help you know your customers like you know your friends. And with data segments tailored specifically for financial services advertising, marketers can rest assured their campaigns meet guidelines for fair and unbiased advertising.

Resources

ebook

Six Trends in Consumer Finance Shaping Marketing

The Ultimate Financial Services Data Playbook

How Predictive Data Helps You Know Your Customers Like You Know Your Friends

Product Booklet

Understand how AnalyticsIQ creates the most accurate view of consumer finances available.

Think You Know Your Customer?

29.2% of the US population is very likely to use cryptocurrency like Bitcoin

Full time students are 90% more likely to be motivated by financial growth

See the Full Financial Picture for Your Audience.

Move forward with confidence